IndexBox has just published a new report: ‘World – Rare Earth Metals – Market Analysis, Forecast, Size, Trends and Insights’. Here is a summary of the report’s key findings.

The global demand for rare earths is continuing to increase. Countries remain reliant on China, which currently provides approx. 55% of global rare earth production. Future projects to develop mining facilities in Russia, the U.S., Japan and Australia may yet weaken China’s leading market hold. The rare earth mineral market is to accelerate on robustly increasing demand from the microelectronics, electric vehicle, wind power and high-tech industries.

Key Trends and Insights

Global rare earth mineral output continues to increase. According to USGS data, global production in 2020 reached 240К tonnes (+9% y-o-y). China leads the output of rare earth minerals, with a figure of 140К tonnes in 2020 (+6% y-o-y). In addition, China boasts the largest confirmed rare earth mineral reserves in the world (44М tonnes). Output is also on the rise in the U.S. (+35.7% y-o-y), Brazil (+40.8% y-o-y), Myanmar (+20% y-o-y), Burundi (+150% y-o-y), India (+3.4% y-o-y), and Madagascar (+100% y-o-y).

The substantial dependence on China, which accounts for 55% of global rare earth production, makes other countries strategically vulnerable: these minerals are widely used in the semiconductor industry, nuclear engineering, mechanical engineering, the chemical industry and metallurgy. China’s decision to restrict exports of rare earth minerals to any particular country could have a serious impact, particularly in terms of their hi-tech industries.

The planned construction of new facilities in several countries worldwide should alleviate the global reliance on Chinese exports. The most significant confirmed reserves are recognized in Vietnam (22М tonnes), Brazil (21М tonnes), Russia (12М tonnes), India (6.9М tonnes), Australia (4.1М tonnes), the U.S. (1.5М tonnes) and Greenland (1.5М tonnes). Given these considerable resources, a shortage of rare earth minerals is not envisaged in the medium term, but it will require tangible investments to make the substantial increase in production feasible.

The Russian government intends to increase its share of production on the global market from 1.3% to 10% by 2030. Investment currently stands at $1.5В and is being directed into 11 rare earth development projects; mining taxes and loan interest rates for involved businesses are being cut.

The U.S., Sweden, Japan, Tanzania, Namibia, Angola, South Africa, South Korea and Australia have also announced plans to establish new production facilities. The construction of a mining facility at one of the world’s largest deposits in Greenland could impact significantly on the global rare earths market. Despite the extensive potential, the resistance from residents regarding the possible threat to the environment has prevented the project from moving forward.

In 2021, Canada launched its first rare earth mining enterprise. The projected output of the Canadian plant is set to reach 5K tonnes of contained rare earth oxides by 2025.

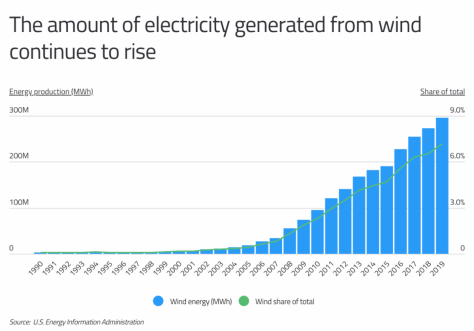

The rare earth metal market is forecast to expand to 313K tonnes by 2030. Demand for rare earth magnets from expanding electric vehicle, electronic and wind power industries will be the main market driver. The use of these metals in low-carbon technologies should further stimulate their consumption.

Global Rare Earth Metal Production

In 2020, global rare earth metal production expanded modestly to 252K tonnes, growing by +2.9% against the previous year. In value terms, rare earth metal production fell to $10.6B in 2020 estimated at export prices.

China (140K tonnes) remains the largest rare earth metal producing country worldwide, accounting for 55% of total volume. Moreover, rare earth metal production in China exceeded the figures recorded by the second-largest producer, Australia (38K tonnes), fourfold. Myanmar (30K tonnes) ranked third in terms of total production with a 12% share.

In 2020, the average annual rate of growth in terms of volume in China stood at +6.1%. The remaining producing countries recorded the following average annual rates of production growth: Australia (-6.5% per year) and Myanmar (+20.0% per year).

Global Rare Earth Metal Imports

In 2020, the amount of rare earth metals imported worldwide shrank to 12K tonnes, waning by -14.1% compared with the previous year’s figure. In value terms, rare earth metal imports reduced sharply to $286M (IndexBox estimates) in 2020.

Japan dominates rare earth metal import structure, amounting to 6.8K tonnes, which was approx. 59% of total imports in 2020. Viet Nam (839 tonnes) held the second position in the ranking, followed by Austria (729 tonnes) and Norway (559 tonnes). All these countries together held approx. 18% share of total imports. Thailand (513 tonnes), India (423 tonnes), the U.S. (301 tonnes), Spain (217 tonnes) and Germany (195 tonnes) followed a long way behind the leaders.

In value terms, Japan ($202M) constitutes the largest market for imported rare earth metals worldwide, comprising 70% of global imports. The second position in the ranking was occupied by Thailand ($22M), with a 7.7% share of global imports. It was followed by Viet Nam, with a 4.4% share.

The average rare earth metal import price stood at $24,706 per tonne in 2020, shrinking by -3.7% against the previous year. In 2020, the most notable rate of growth in terms of prices was attained by the U.S., while the other global leaders experienced more modest paces of growth.

Source: IndexBox Platform