Doing Business Under COVID-19: Going Online to Weather the Storm

At the time of this writing, there are now unprecedented restrictions being put in place to prevent the spread of the 2019 novel coronavirus or COVID-19, its official designation by the World Health Organization. These actions have been proposed as necessary steps in order to prevent the spread and transmission of the disease. However, its impact on the socio-political and economic fronts cannot be overlooked.

Such is the nature of this virus and the ensuing government actions that this will likely forever change how we do business not only in our individual nations but across the globe as a whole.

The technological revolution has already progressed sufficiently to allow for automation in a great many industries, but how can small and medium-sized businesses prepare before the next global pandemic?

Even in times of crisis, businesses still need to maintain communications with global partners, clients, and stakeholders. Get in touch with Tomedes’ crisis communication center.

The Social Impact of COVID-19

Somewhere, some kid woke up in their dream utopian world, where they were forced to stay at home, playing video games in the basement, not having any physical contact with the outside world, or at least no more than necessary to order a pizza. Elsewhere, entire societies have been adversely impacted as restaurants, entertainment venues and other gatherings have been declared off-limits to the people.

Gatherings as seemingly innocuous as church meetings have been canceled, leaving many people suffering from the onset of cabin fever as they find themselves more and more isolated and incapable of participating in virtually any social engagement. This particularly impacts societies that value physical displays of affection between family members, friends, and acquaintances, along with the need to sustain relationships and friendships in a traditional hands-on manner.

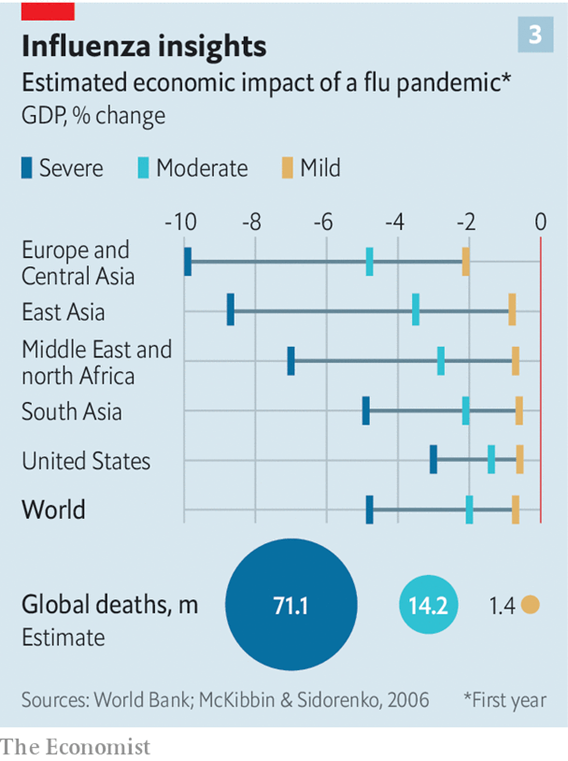

The Economic Impact of COVID-19

Source: The Economist

Perhaps the most damaging disruption is that the COVID-19 is bringing the world economy to its knees, bankrupting many businesses for all sizes, and laying off employees by the droves, depriving them the ability to provide for themselves and for their families. With families still experiencing the shocks and crunches of the 2008 Financial Crisis and the Great Recession, along with the economic setbacks from the US-China trade war, the coronavirus pandemic couldn’t come at a worst time–not that it should have come at all. The pandemic is now having a rippling effect that expands throughout the global economic system as evidenced from the current global economic crisis.

Manufacturing of non-essential goods is now scaling back to even being suspended. Logistics and material supply chains are lagging behind which is then causing a domino effect, ultimately resulting in utter economic turmoil leaving entire sections of the economy beaten, battered and bruised with little hope for any immediate resolution.

Perhaps this outbreak will forever change the way that people work, shop and even how they live their lives. There are some industries that are currently thriving even during these economically depressed times. There are other businesses that are dying but some, with a little bit of effort and foresight, could be in a much better position during the next global outbreak.

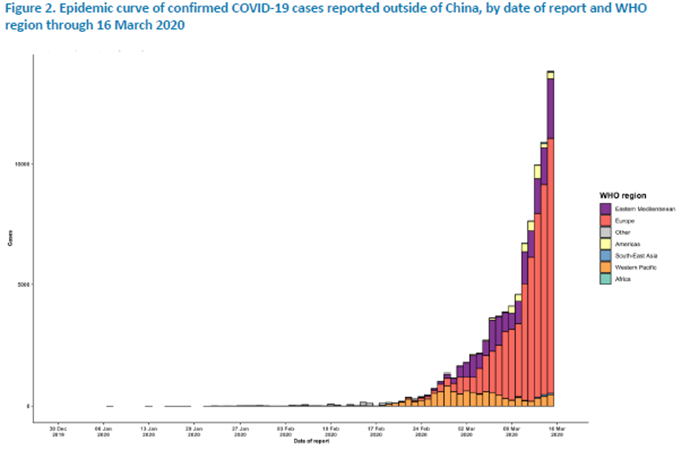

Which Industries are Thriving During the Global COVID-19 Pandemic? And Why?

Source: World Health Organization

Despite the constant economic turmoil that is ongoing as a result of the current global pandemic, there are numerous industries that are thriving or at the very least, continuing operations. Many businesses that have already established themselves online in one form or another, are at the very least, not suffering as badly at present. Although, situations in some industries are mixed as some are forced to scale down their operations. Some are obligated to keep going considering the vital nature of their operations with profit being the least of their concerns as of the moment.

Tech Industry

As people continue their quarantine and lockdown lifestyle, they’ll naturally go online and browse all content they’ll come across to pass the time. Social media platforms are now experiencing a surge in content with people now having more time on their hands than usual. Streaming companies such as Netflix are also having a field day as ‘Netflix and chill’ routines are now the norm for more people for the next few weeks at least.

As for consumer electronic manufacturers, it’s fair to say that people’s consumer habits have changed from conspicuous spending to practical spending. There’s significantly less demand now for luxury products and consumer electronic products with the exception of consumer medical devices. It’s much more practical now to purchase a thermometer and digital blood pressure monitor than the latest iPhone or pre-ordering the upcoming PS5.

Ecommerce

The global ecommerce industry is facing mixed experiences as we speak. One can assume that as people stay indoors, ecommerce businesses are bound to have a field day. In reality, it entirely depends on your product inventory whether you sell essential goods, medical devices, or consumer electronics and so on. The impact on ecommerce businesses also depend on how much they rely on the global supply chain.

Since the pandemic has initially brought China’s manufacturers to a halt, everyone from ecommerce businesses to global retailers are taking a big hit. Some ecommerce businesses are forced to suspend their operations and even close up shop as they can’t restock their inventory. However, other ecommerce businesses are unable to cope with so much demand as people continue to stock up on essential goods.

Logistics

The global logistics industry is now the lifeblood holding the global economy together that’s currently hanging on by a thread. From supermarkets, relief operations, healthcare centers, to families, it’s imperative that logistics companies around the world keep running round the clock to deliver not only essential goods but also vital medical supplies of all kinds from testing kits, face masks (surgical, N95, etc.), to face shields, safety goggles, protective suits, and disinfectants.

However, there are some logistics companies that are on the losing end as many have been forced to scale down to even suspend their operations temporarily as the logistics workforce are highly susceptible to viral transmission.

Energy and Utilities

With families now staying, working, and continuing their schooling at home, energy and utility companies will naturally see a tremendous spike in operations. But whether this is profitable for their industry isn’t as black-and-white as one might think. Many energy and utility companies around the world are now extending bill payments to a month to cushion the financial toll families and businesses are currently experiencing. For energy and utility companies, perhaps profit isn’t their main concern now as they’re now working hard to keep their services uninterrupted and not putting lives at risk.

Medical Industry

The global medical industry is now in overdrive with some even classifying their operations as being elevated to ‘wartime’ level. However, we wouldn’t classify it as thriving per se in terms of opportunities and increased revenue. All health professionals and relevant frontliners are now overstretched around the world and facing dwindling medical supplies as cases rise.

It’s fair to say that the pandemic is putting even the most advanced healthcare systems under enormous pressure. The medical industry from healthcare providers, pharmaceutical companies, medical device manufacturers, and disinfectant manufacturers are now working round the clock to keep up with the pace of infections to keep it from spiraling out of the control.

Another part of the medical industry that’s seeing a spike in demand are unconventional medical services such as telemedicine and online mental health services. Doctors are highly vulnerable to viral transmission and must be protected at all costs. For patients with non-serious symptoms, telemedicine is the safest way to get a check-up from your doctor.

As for online mental health services, the abrupt social isolation along with some families even being mandated to isolate themselves from their own loved ones to prevent transmission within the household is having a damaging toll on people’s mental health.

The Language Industry

Business is booming for many aspects of the language industry, especially online translations. This is in large part due to the requirements of scientists, academics and medical professionals working around the world to stem the tide of the global COVID-19 pandemic. All of the research, the latest breakthroughs, and the research and analysis of these medical professionals must be quickly and accurately translated and then distributed to similar communities around the globe. Medical translation is also needed in the medical device industry as medical devices such as testing kits need to be accurately translated for it to be used properly by all countries affected by the pandemic.

Live interpreters are less in demand, though there are still exceptions, most notably in the medical, political, and public relations arena where communications must continue. Even here however, more and more of the work is being conducted via video conferencing and using other online means to prevent the need for gathering together unnecessarily. Translation agencies and even freelance translators and interpreters working online are experiencing an increased demand for their services when other industries falter.

The Freelance Industry

There were many claims made from both sides of the debate during the passage of AB5 in California, more commonly known as the “Gig Economy Bill”. Despite all of these claims however, freelancers online have experienced a record surge in terms of both the number of people looking for freelance work and the amount of work being moved to the “online economy”.

But not all freelancers can claim all is well unfortunately as the effects of the pandemic does naturally vary between industries. While many freelancers working online are enjoying a great boom in business, other freelancers providing on-site services such as consultants and even freelancers working for film and TV history, are having a rough time as we speak.

Setting Up Your Business Continuity Plan Amidst the Coronavirus Pandemic

Moving a business online is not only beneficial, but given the current economic and social crises, it may soon become inevitable, especially as the technological revolution automates industry and replaces more traditional jobs. There are additional benefits to the company as well.

The individuals working from home do not require expensive computers, desks or other equipment that the business owner would otherwise be forced to acquire. The business owner will not have to pay for all of the electrical consumption or other utilities that would otherwise be an added expense.

Even businesses that cannot be fully established online will benefit from an online presence. Localized service providers who only provide a limited service in an equally restrictive geographic location are one such example. Still, there are many aspects of the business that can be conducted online without any or at the very least, minimal disruption to the services being provided.

Moving Operations and Transactions Online

Accounts Payable and Receivable, IT services if there are any, and a host of other jobs can easily be completed through the use of professional agencies online, or by hiring employees who will be telecommuting, or working from their own homes. Some of the work may be outsourced to professional agencies and freelance workers online. But virtually all of it can be done without the need to congregate together in a closed, more restrictive environment.

Shift to Telecommuting

Companies that retain all or even a portion of their staff as telecommuters will be in a better position to weather the financial storm created by the current crises. This may perhaps be best demonstrated oddly enough, by looking at the internet and how it works. IT professionals are among the most common people in the industry working as telecommuters online. As long as there is internet, then there is work for people.

Likewise, programmers are able to work from home, as are customer service representatives and other key positions working in IT. Any company that can establish as much of its workforce as possible as telecommuters will enjoy numerous benefits that will be explained in the latter portion of this article.

Maintain a Skeletal Workforce for Operations if Possible.

As of writing, many businesses have had to make changes overnight from moving their operations online to even laying off a part of their workforce just to keep their business afloat. With the employees you have left, it’s important to also keep your business running by maintaining a skeletal workforce to focus on vital operations for the time being.

Using Voice Over Internet Protocol (VoIP) Services

Using VoIP services such as Skype and Facetime is a perfect way to continue face-to-face interactions not only with your employees but also clients. These are mostly free but do come with premium subscriptions if you want more access to its features as video group calls.

Expanding Your Ecommerce Capabilities

Some local businesses may already have an online presence, but may also need to consider expanding their services that are offered online. Any company that has a physical product that is going to be shipped out, or that offers online products, may want to consider the addition of an ecommerce or merchant page on their website.

This gives the business owner access to a much larger audience while at the same time, more fully automating much of the checkout process and reducing the number of employees required to perform the job functions.

Upgrade Your Content Marketing Strategies

Unlike printed ads or brochures, a website can also contain videos, which are a primary tool in every internet marketing campaign. This is especially true if the videos are used to introduce products to the customers, which is a very effective technique for increasing sales online.

Videos also have been shown to do better when they include closed captioning or video translations. Many people who are searching for products and services online will prefer the videos and watch them rather than read through large volumes of text.

The inclusion of video closed captioning through video translation services will allow for the customers to enjoy the full video experience without having to worry about missing anything, even when they have the sound turned off. Given the extent of the potential audience though, video translation and video marketing are excellent and necessary tools for an online marketing campaign as more people stay at home.

Relying on Customer Relationship Management (CRM) Platforms

You might have already been using CRM platforms but in these times, they couldn’t be more necessary now as your business continues operations online. CRM platforms make the process of monitoring clients and keeping track of relevant client data much easier. CRM platforms now run under cloud systems which means your employees can continue their services from the safety of their home.

Shift to Employee Management Strategies using Employee Tracking Tools

It’s fair to say that going online is a whole new realm, figuratively and literally. Business owners and managers need to be inundated with the latest online management strategies to keep track of their employees performance. One of the most vital essential tools in online employee management are employee tracking tools.

Employees can clock in and clock out per shift as they did before in which the tool will keep track of the total number of hours they’ve worked. Another useful feature in employee tracking tools is it takes screenshots of your employees’ screens. This helps managers know whether or not their employees are actually working on the tasks at hand rather than streaming Netflix.

Use Localization to Try to Get Ahead of the Curve

Let’s talk more about localization here and how you can get provided an elevated online customer experience for your foreign audiences and markets, especially during these trying times. Among the most popular online trends for business in 2020 is globalization through localization. Localization is all about speaking to the target demographic in their own language not just in a linguistic sense but also culturally and socially.

You’ll be using their preferences and norms as points of reference to help you refine your product and marketing strategies. This involves establishing a full business presence online in numerous different markets, using language and references that the people will understand from a more localized and personal perspective.

Localization indeed is more than just language, but translation itself under localization takes on a new form. Localizing translations involves taking note of regional linguistic nuances. Language differs greatly, even when everyone involved in the conversation speaks the same language. Think about the local vernacular, local phrases and local accents. Add in local frames of mind and points of reference, and even in different areas that speak the same language, different localization techniques will be required.

In many areas of the world, it will be necessary to use two or more local languages. The province of Quebec generally requires both French and English if it is to be effective. Locations around the Southern border of the USA may require both English and Spanish. Many locations throughout Europe commonly use numerous languages. Switzerland recognizes German, French and Italian as official languages, but also has a strong presence of Romansh. In such a case, four or more languages may be required to be translated for the website. In Switzerland, staying there for a moment in time, the areas for each language are generally geographically specific.

Each one of these geographic areas will have unique features and individual points of pride for the local populations. The ability to integrate these into a larger online campaign using localization strategies means that each one of these languages can be used to more specifically target the desired audience.

The best means to accomplish such a task is to ensure that when moving online, a translation agency that specializes in localization strategies is used in order to ensure both the accuracy and the individual aspects of a more complete, professional and personalized translation service. In some cases, these techniques will be crucial even for a more localized and restricted online business presence.

In other cases, they may be part of a broader globalization campaign, though using the same techniques of localization. However, there are places in the world that lack regular internet access. Some research may need to be done on who will be your ideal target audience.

Going Online Amidst Medical or even Economic Crises: Final Word

For those businesses that can go completely online, there will be no more need to worry about where people can or cannot gather, or what people can or cannot do in person. Many of these companies have the added benefit of creating online products and services that can be delivered over the internet. Furthermore, the expansion of the online economy will keep the world economy going rather than flatlining.

The impact on ISPs and the relevant infrastructure have already pointed out the need for some expansion of the underlying infrastructure of the internet. It will create the need for more and better infrastructure to be built, resulting in even more work being made available online.

Overall, building a business online may seem like a rather small affair at first glance. However, just as is the case with the current social and economic crises the world is facing, the gains of an online business can create the very same rippling and domino effects in the opposite direction. The creation of more industry results in the creation of more jobs even in times of economic turmoil, and does more than just its “fair share” to aid in the global economic recovery.

_____________________________________________________________________

This article originally appeared on Tomedes.com. Republished with permission.