In their first two installments (which you can view here and here), George Y. Gonzalez and Jesus Alcocer respond to the gaps exposed in the supply chain by the pandemic by proposing a shift away from overreliance on China and a shift towards reshoring manufacturing closer to home. In their final installment, they will explore how the potential cost of reshoring out of Asia to North America could be lessened if capacity is relocated to Mexico, a natural alternative. Wrapping up their discussion, they will also examine how Houston may serve as a central hub for cross-national manufacturing and trade.

Mexico Has Also Been a Beneficiary of This Shift Out of China

Mexico has benefited from this rearrangement almost as much as Vietnam. According to A.T. Kearney, manufacturing imports from Mexico rose $13 billion to $20 billion in 2019. Thanks to this climb, the U.S. now imports 42 cents from Mexico for every dollar it purchased from LCAs, up from 37 cents during the past seven years. This pattern has also extended into 2020. In the first quarter of this year, imports in maintenance and repair, construction, and insurance sectors all grew in the triple digits, while imports of information and communications technology products (“ICT”) grew 20% year-on-year.

The trade relationship between the two North American countries has developed in spite of political obstacles. The Trump Administration imposed tariffs on Mexico-produced steel in 2018 but removed those barriers in May 2019. Likewise, Andres Manuel Lopez Obrador, Mexico’s president since 2018, was widely regarded as a nationalist suspicious of international trade. According to the Congressional Research Service, “in the area of foreign policy, President-elect López Obrador generally has maintained that the best foreign policy is a strong domestic policy.… Some observers feared that López Obrador might roll back Mexico’s market-friendly reforms and adopt a more isolationist foreign policy.” Against these inauspicious circumstances, bilateral trade has grown steadily since 2016. Mexico surpassed Canada as the U.S.’s largest trade partner in 2019. In 2013, Canada exported 8.3% more to the United States than Mexico. Now the order has reversed, with Mexico exporting .5% more than Canada into the U.S.

Growing imports can be partly explained by a hike in U.S. FDI in Mexico, which grew approximately 5.2% between 2018 and 2019 to $100.89 billion. Investment in primary and prefabricated metals manufacturing close to doubled from 2015 to 2019 to close to $2.27 billion, while FDI in machinery manufacturing grew about 25% during that same period. These are some of the industries where U.S. FDI in China has dropped most sharply, as explained above. Rising FDI stock was driven by waves of U.S. companies establishing a base or increasing their footprint in Mexico, following the market-oriented reforms in that country in the last decade. According to A.T. Kearney, by 2016 more than half of U.S. companies with manufacturing operations in Mexico had relocated production therefrom places such as China to supply the U.S. market.

Moreover, according to the Boston Consulting Group, some major Chinese consumer electronics manufactures have been adding capacity in Mexico to serve demand in Latin America. This broadly corresponds to the Chamber survey referenced above, which indicates that while LACs are still the top relocation choice for U.S. firms, North America is an increasingly popular option. Close to 17% of the firms dislocating their operations from China in 2020 indicated they would move that capacity to Mexico or Canada, up from 10% in 2019. An additional 22% reported they would move it to the U.S., up from 17% in 2019.

Mexico as a Natural Alternative

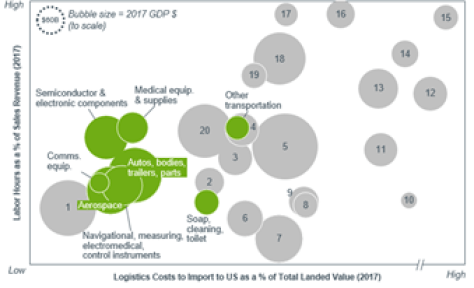

Mexico is already the U.S.’s largest trading partner, as well as the manufacturing base for a substantial part of its products. Last year, Mexico traded $614 billion with the U.S. – surpassing Canada ($612 billion) and China ($558 billion). “Merchandise trade between the two countries in 2018 was six times higher (in nominal terms) than in 1993, the year NAFTA entered into force,” according to the Congressional Research Service. Among the leading U.S. exports to Mexico are “petroleum and coal products ($28.8 billion or 11% of exports to Mexico), motor vehicle parts ($20.2 billion or 8% of exports), computer equipment ($17.4 billion or 7% of exports), and semiconductors and other electronic components ($13.1 billion or 5% of exports).” On the other hand, the top U.S. imports from Mexico in 2018 included “motor vehicles ($64.5 billion or 19% of imports from Mexico), motor vehicle parts ($49.8 billion or 14% of imports), computer equipment ($26.6 billion or 8% of imports), oil and gas ($14.5 billion or 4% of imports), and electrical equipment ($11.9 billion or 3% of imports).”

Increasing the cross-border manufacturing prompted by NAFTA may be the most practical way for the U.S. to eliminate its cost gap with China. “Many economists credit NAFTA with helping U.S. manufacturing industries, especially the U.S. auto industry, become more globally competitive through the development of supply chains in North America. A significant portion of merchandise trade between the U.S. and Mexico occurs in the context of production sharing as manufacturers in each country work together to create goods.” Mexico’s wage growth is on par with Vietnam’s, but Mexico’s productivity is about 5.2 times higher. Mexico’s combination of low labor costs and relatively high productivity result in production costs that are 20-30% lower than in the U.S. (including transportation and associated fees).

Mexico also has an important advantage vis-à-vis China with respect to transportation costs, which account for a significant portion of costs in industries like metals and automotive parts. Shipping a 40-foot container loaded with automotive parts from Shanghai to Los Angeles cost an average of $1,374.03 – $1,518.66 (before taxes and duties) in July 2020. Shipping that same container from Veracruz, in the Gulf of Mexico, to New York, cost $1,102.24 – $1,218.27. Sending that same container by truck from northern Tamaulipas, where a large portion of the country’s manufacturing base is located, to Houston cost an average of $304.11 – $336.12 – four to five times less than shipping it from China. Mexico also maintains a clear edge in delivery time. It takes 75% less time to transport goods to the customer from Mexico than from Asia. Proximity is an essential advantage in industries that are shifting towards highly personalized products, including electronics, automotive, and clothing. The short distance can also be exploited to combine the countries’ supply chains across the border, one of the main drivers of economic growth under NAFTA.

According to the Center for Car Research, between 80 and 90% of U.S. automotive trade is intra-industry, and parts produced in Mexico and the U.S. cross the border up to eight times along the manufacturing process before they are delivered to consumers. In fact, on average, close to 40% of the content of a vehicle produced in Mexico was initially imported from the United States. This tight integration was only achieved after the NAFTA, which allowed producers to spread their supply chain across the border. Before 1993, for example, the vehicles produced in Mexico contained only 5% of parts produced in the U.S

The Effect of the USMCA

NAFTA completely changed the landscape of North America by driving unprecedented integration in the region and generating a dramatic increase in trade and cross-border investment. NAFTA also had an essential role in promoting Mexico’s privatization, where state-owned enterprises represented a substantial part of production until at least 1988. Between 1988 and 1994, 390 Mexican businesses were privatized – close to 63% of large corporations in the country. Telling of Mexico’s explosive development in this era is that before 1988 there was only one billionaire family in Mexico: Monterrey’s Garza Sada, who made their fortune selling beer and steel. In 1994, however, Forbes’s ranks included 24 Mexican billionaires. Between 1993 and 1994 alone, the number of multimillionaires in the country rose by 85%.

The USMCA, which consists of 34 chapters, four annexes, and 14 side letters, will further encourage growth by maintaining the most important aspects of NAFTA: a legal framework with protections for foreign investors and a free-market zone between the three nations. It will also maintain investor-state dispute settlement (ISDS) “between the United States and Mexico for claimants regarding government contracts in the oil, natural gas, power generation, infrastructure, and telecommunications sectors; and maintains U.S.-Mexico ISDS in other sectors provided the claimant exhausts national remedies first.” According to the Congressional Research Service, ratification of the treaty was expected to remove some investors’ unease about domestic policy uncertainty and the international economy. “Longer-term prospects for export-oriented manufacturing, as well as oil production, appear positive,” according to that report. After the elimination of steel tariffs on Mexico and Canada in May of last year, the International Monetary Fund (IMF) estimates that the USMCA will increase trade between the three North American countries by approximately $15 billion.

Among the most significant achievements of the USMCA is that it will accelerate the integration of energy [utilization] on both sides of the U.S.-Mexico border. The treaty maintains NAFTA’s zero tariffs for energy products, which have made Mexico “the No. 1 export market for U.S. natural gas and refined products and the No. 4 export market for upstream oil and gas equipment.” It also locked in Mexico’s historic 2013 energy reform, which allowed foreign investment in oil and gas. Previously, state-owned Pemex was the only company allowed to invest in Mexico’s energy sector, a state of affairs that NAFTA explicitly acknowledged. The USMCA also facilitates the transport of energy products. For example, it allows “hydrocarbons transported through pipelines to qualify as originating, provided that any diluent, regardless of origin, does not constitute more than 40% of the volume of the good.” Lastly, it maintains the automatic export approvals for U.S. liquified natural gas (LNG) that is exported to Mexico or Canada.

Another key feature of the treaty is the customs administration chapter. This section mandates streamlined procedures that lower the time, complexity, and cost of exporting and importing many goods. According to the IMG, “most of the benefits of USMCA would come from trade facilitation measures that modernize and integrate customs procedures to reduce trade costs and border inefficiencies further.” The international organizations indicate these new procedures could lead to “one-tenth of a percent reduction in regional merchandise trade cost.” This section will also boost the trade of low-value products because it raises the value-thresholds for products eligible for tax-free, duty-free, streamlined customs, treatment. Mexico’s $50 limit for tax-free entry has remained the same, but products up to US $117 can now enter duty-free entry through a simplified customs processes. The IMF expects these modifications to benefit small and medium businesses, as well as online retailers. They may also have an impact on manufacturing processes where the value of parts that cross the border is low.

The treaty also strengthens IP protections. Intellectual property is one of the U.S.’s most significant exports, and IP-intensive industries generate 45 million jobs in the U.S., as well as close to $6 trillion dollars per year (38% of the GDP). This is also one of the sectors where the U.S. has enjoyed a significant and consistent trade surplus. According to the Congressional Research Service, “IP-intensive goods and services are an important part of U.S. trade with Canada and Mexico.” Chapter 20 of the USMCA established a committee on IP rights, which will deal with concerns related to trade secrets and patent litigation, as well as a mediator in some IP disputes. The USMCA also extended minimum copyright protection to 70 years, up from 50 years under NAFTA, and retains a minimum of 20 years for patent protections. Moreover, it empowers copyright possessors to “expeditiously” enforce their rights in online settings. Law enforcement officers are also entitled to “stop suspected counterfeit or pirated goods at every phase of entering, exiting, and transiting through the territory of any Party.” Lastly, many violations of copyright and trade secrets, now carry criminal sanctions under the treaty, including cyber theft — even if the perpetrator is a state-owned entity.

The USMCA’s strong IP protection contrasts with the perceived weaknesses of China’s IP regime. In 2018, a U.S. Trade Representative’s investigation indicated that the U.S. government would take actions to curve China’s “forced technology transfer requirements, cyber-theft of U.S. trade secrets, discriminatory licensing requirements, and attempts to acquire U.S. technology to advance its industrial policies.” For instance, U.S. Customs and Border Protection reported stopped $1.2 billion of IP-infringing goods at coming into the U.S., with China being the largest source.

The onset of the COVID-19 pandemic has revamped reported IP violations of Chinese entities in the pharmaceutical industry. The Wuhan Institute of Virology recently applied for a patent of a compound based on Gilead Sciences -produced Remdesivir, which has been hailed as a potential medication for COVID-19 patients. China-based BrightGene Bio-Medical Technology Co. is also in the process of manufacturing a Remdesivir generic. It is worth noting “that Gilead’s patent application in China for Remdesivir use in coronaviruses has been pending since 2016.” The Chinese government has also found a potent tool to promote technology transfer through its antitrust law. “China has required technology transfer in antitrust reviews of foreign firms in China 2025 sectors,” according to the Congressional Research Service.

Finally, the treaty includes new rules that will require Mexico to increase the wages of some of its workers in the automotive industry and to source a larger part of its manufacturing materials within North America. Vehicles must now contain at least 75% of content sourced in North America to be eligible for tariff exemptions. Likewise, it dictates that at least 70% of a producer’s steel and aluminum purchases must originate in North America to be eligible for exemptions and eliminates several loopholes that allowed for transshipments under NAFTA. These sections were aimed in part at encouraging member states to displace Asia as the source of steel, aluminum, and electronic components, according to a professor at the business school of the Tecnológico de Monterrey.

The Mexican government has been in talks with a host of Asian steel producers, including South Korea’s POSCO, Japan’s Nippon Steel Corp, and Mitsubishi Corp, about the possibility of manufacturing steel for the auto sector in Mexico, in order to take advantage of the local content rule, according to Reuters. The news agency also reported that Andres Manuel Lopez Obrador’s administration is enticing Apple to set up manufacturing bases in the country. “These phones don’t have to be produced in China … there is an enormous opportunity to produce them” in Mexico, Economy Minister Graciela Marquez told Reuters.

The Mexico Texas Relationship

The relationship of Mexico with Texas is historical and current. The Lone Star State was part of Mexico until 1836. Today, people of Mexican ancestry account for close to 36.6% of Texas’s residents, and Spanish is spoken in the homes of close to 30% of Texans, according to data from the U.S. Census Bureau. Their economic ties are as strong as their cultural and ethnic ones. Texas accounts for 44.41% of the U.S.’s trade with Mexico, followed by California – which accounts for 11.6%. Mexico is also Texas’s largest foreign trading partner, representing 43.79% of its exports and 35.15% of its imports. China, in contrast, makes up for 8.7% of Texas’s exports, and 14.6% of its imports Texas also carries approximately 72% of all imports by value coming from Mexico to the U.S. Laredo, which received $132 billion in imports from Mexico by truck last year, itself accounts for about 40% of all truck cargo from Mexico into the U.S., according to data from the Department of Transportation.

Mexico and Texas’s heavy trade in oil products and vehicles underscore the robustness of their trade relationship. Oil and bitumen substances corresponded to 21.8% of Texas’s total exports to Mexico in 2017. Texas also accounted for 61.5% of propane and 40.9% natural gas Mexico purchased from the U.S. Likewise, oil represented close to 10% of Mexico’s exports to Texas, which is about 69% of all oil Mexico exports to the U.S. The USMCA, by maintaining zero tariffs in energy products and reinforcing Mexico’s energy reform, will potentiate trade in this area. Mexico exported approximately $5.3 billion worth of vehicles to Texas in 2018, close to 23% of the total value of the vehicles it exported to the U.S. that year. An important part of this trade takes place within the automotive manufacturing process, where energy cost is a critical component.

Can Houston Become North America’s Hong Kong?

Houston is well-positioned to serve as a hub for the growing trade cross-national manufacturing base in the U.S.-Mexico border. Houston serves as a gateway for a substantial portion of foreign trade in the U.S. and is ranked as one of the easiest places to do business in North America. Texas’s ports receive more cargo than any other state at 573 million tons – which accounted for approximately 23% of all waterborne cargo in the U.S. in 2018. Neighboring Louisiana is the second largest with 569 million tons. California, in contrast, carried 249 million tonnes – less than half of Texas’s amount, according to data from the U.S. Army Corps of Engineers.

Houston itself was the largest carrier of international cargo in 2018, at 191 million tons (up 10% year on year). The port of Houston, however, is not the only one in the metropolitan area. The ports of Texas City, Beaumont, Port Artur, and Lake Charles (Louisiana) together account for approximately 508 million tons of water cargo, including 336 million in foreign cargo. This is equivalent to about 20% of the total tonnage of the largest 150 ports of the U.S., as well as 22% of foreign cargo.

In terms of shipping, the city of Houston plays a similar role as Hong Kong does within the China ecosystem. Hong Kong’s port handled 19.6 million TEU in 2018, while China processed approximately 245.6 million TEU, according to the World Bank. Based on this data, Hong Kong accounted for about 8% of container shipping by TEU in China, while the port of Houston accounted for about 10% of U.S. sea cargo by weight. Similarly, when conflated with the nearby ports of Shenzhen and Guangzhou, Hong Kong constitutes about 28% of container trade in China. Houston, along with nearby ports and the Port of Southern Louisiana, accounted for close to 31% of the total cargo by weight in the U.S.

Houston’s role in the U.S.’s overall economy is also similar to Hong Kong’s role in China. The Houston metro area generated approximately $478 billion in 2018 or close to 2.2% of the country’s total. This is analogous to the proportion that Hong Kong contributed to China in 2019. Last year, China’s GDP by purchasing power parity (PPP) was approximately $21.4 trillion ($14.3 trillion in current dollars), while Hong Kong’s stood at $467 billion that same year ($366 billion in current dollars). Hong Kong, therefore, accounted for approximately 2.5% of China’s GDP.