The COVID-19 pandemic has exposed the weaknesses of supply chains on which nearly half of the population relies on for life-saving medication. Countries have enforced restrictions on the flow of essential medical supplies in a bid to save their own populations. States competed with the Federal government for ventilators in the market, paying multiples of the devices’ usual prices. Doctors, working in painfully under-supplied hospitals, folded plastic sheets to make their own protective masks. Many U.S. hospitals have had to connect multiple patients to devices meant to sustain the life of one. Hospital doctors and administrators have already been asked to decide who should live and who should die.

Understanding the need to transform the current supply chain, the following is the first part in a three-part series that examines how the promise from the COVID-19 pandemic is a manufacturing renaissance in North America. This first installment will lay the groundwork for understanding the current deficiencies within the supply chain and then pivot to explore the dangers of over-reliance on foreign exporters and what challenges U.S. companies are continuing to face in China.

The Current State of the Pandemic Supply Chain

It is late March 2020. In New York’s Presbyterian hospital, doctors are wrangling to accomplish something that “hasn’t really ever been done before,” at least not according to Dr. Jeremy Beitler, a pulmonary disease specialist. The hospital, one of the world’s largest, is affiliated with two Ivy League institutions and routinely ranks as one of the top five health centers in the U.S. Inside its contemporary art-clad walls doctors are connecting two people to a ventilator designed to sustain a single set of lungs. The process, which had been only tested in animals before, carries with it a host of risks because sharing does not double ventilator access, and many victims need their own device. Moreover, the two patients need different volume and pressure levels, – which means that often one or both cases are kept in sub-optimal settings.

Professionals, including the editor in chief of the journal Respiratory Care, have warned against ventilator sharing, arguing that “the time to try an untested treatment not previously used in humans is not amid a pandemic.” For the doctors in charge of triage at New York’s Presbyterian, however, the other option was death. As Dr. Charlene Babcock, an emergency doctor in Detroit puts it: “If it was me, and I had four patients, and they all need intubation, and I only had one ventilator, I would simply have a shared discussion meeting with all four families and say, ‘I can pick one to live, or we can try to have all four live.’”

This technique has now expanded across the country, as state governments fought to outbid each other to purchase one of the few ventilators left in the market. The machines went to the highest bidder. It has been four months since that day in March, but the situation that led doctors to attempt an untested off-label procedure in one of New York’s top hospitals stems from issues that run much deeper.

Foreign companies made close to 50% of the intensive-care ventilators in the U.S., where at the time, there were fewer than 12 manufacturers with the capabilities to produce them. As the COVID-19 pandemic advanced, even these U.S. manufacturers found it impossible to sharply increase their supply since the hundreds of parts that make up these complex devices were sold by companies across the world. It would take at least eight months for St. Louis-based Allied Healthcare Products to revamp its supply chain and meet the rising demand, according to the New York Times. In less than seven months, there have been close to 150,000 reported COVID-19 deaths in the United States.

This fragile state of U.S. healthcare supply was exposed by an inadequate manufacturing base that had been deteriorating for years. The toll of COVID-19 has revived efforts to overhaul the capabilities of manufacturers in the U.S. – an issue that had been dormant for decades, as manufacturers moved to jurisdictions outside the U.S., principally to Asian countries in pursuit of lower costs. Just last week, newspapers heralded the “end of an era” in U.S. manufacturing as Intel, the largest chipmaker in the country, announced it was finally considering outsourcing its production to Taiwan and South Korea. This policy was embraced by Intel’s competitors but shunned by the Silicon Valley giant for decades.

The COVID-19 pandemic has triggered an unprecedented new consciousness among the U.S. business elite of the potential risk of over-reliance on a supply chain substantially based in Asia. This new consciousness, in the midst of the pressure of COVID-19 on supply chains, the rising public support for economic rescue measures, and the recent signing of the United States–Mexico–Canada Agreement (USMCA) can collectively act to usher in an era of renewed manufacturing in North America.

The USMCA buttresses the free market access among the three North American economies and ensures U.S. producers access to low-cost labor in Mexico. Importantly, it locks in Mexico’s 2013 energy reform, which allows foreign companies to invest in the country’s energy sector and eliminates barriers to trade in energy commodities. Together, these provisions pave the way for more fully integrating the cost-competitive production base in Mexico with the technical know-how of U.S. manufacturers – a combination with the potential to shift the manufacturing center of gravity out of Asia.

Dangers of Overreliance

Heavily relying on a global supply chain for crucial products is costly. COVID-19 has underlined the dangers of relying on China and other foreign nations for essential supplies and compounded the anti-globalist sentiment that had been developing in the U.S. in the last few years. Close to 68% of Americans surveyed by Pew Research Center supported trade and growing business ties with foreign countries in 2014. In contrast, only 47% said globalization was good for the United States in May of this year.

The U.S. imported close to $472 billion from China in 2019, down from $559 billion in 2018, according to the Bureau of Economic Analysis (BEA). In absolute terms, the most significant component of these imports is consumer products, followed by capital and industrial goods. In relative terms, however, electronics and pharmaceuticals are the sectors on which the U.S. is arguably most dependent on China. In 2019, the U.S. imported close to 70% of its consumer electronics from China. Mexico, Korea, and Vietnam: the next three largest contributors, together, accounted for 19%. The extent of this dependence is underscored by executives in the auto industry, who told The Wall Street Journal that “they could run out of certain parts used in U.S. factories in coming weeks, with particular concern over potential shortages of electronic components,” as the pandemic forced Chinese factories to temporarily close their doors in February.

Emergent consciousness of the U.S.’s lack of self-sufficiency is perhaps most starkly obvious in the healthcare sector. According to consulting firm A.T. Kearney, close to 70% of protective masks in the U.S. are made in China, as well as 80% of the country’s antibiotic supply – including 95% of ibuprofen and 91% of hydrocortisone. Moreover, some widely used blood-pressure medications and antibiotics are no longer produced in the U.S. at all, and experts warn that China is the only known producer of certain key ingredients in antibiotics used to treat diseases like pneumonia. As of April 2020, 79 countries had imposed export bans or restrictions on essential medications and medical supplies to the U.S. market. India alone banned exports of 26 critical active pharmaceutical ingredients. The resulting undersupply in the U.S. may have already endangered national health. In the U.S., roughly half of the population is dependent on prescription drugs, and the majority use over-the-counter medicines on a regular basis.

Building manufacturing expertise in critical sectors such as healthcare as soon as possible should be a strategic policy goal. Unlike other industries, manufacturing pharmaceuticals requires knowledge and capacity that cannot be built in the short term. According to A.T. Kearney, some types of ventilators and antiseptics are among the easiest products to utilize cross-industry capacity to produce. This, of course, contrasts with the critically low supply of ventilators described above, and the government’s unsuccessful 13-year attempt to shore up that supply. Moreover, even if companies could be outfitted to assemble these complicated machines in the short term, replacing the global supply chain of parts may take much longer.

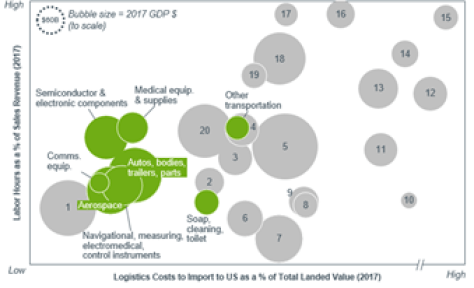

COVID-19 is testing supply chains across the whole economy. According to A.T. Kearney, close to 82% of companies surveyed indicate the pandemic has profoundly disrupted their supply chain. In comparison, only 5% of U.S. manufacturers indicate the disruption has been minimal. Similarly, according to consulting firm McKinsey & Company, material shortages were the top COVID-19 operational challenge for corporations, with close to 45% of respondents agreeing. This option comes ahead of drops in demand (41%) and cash-flow issues (22%). McKinsey indicated advanced industry, including auto-manufacturing, was the sector most affected by the supply shock, “primarily due to interconnected supply chains spanning multiple geographies.”

The U.S.’s reliance on Chinese imports contrasts with China’s self-sufficiency. According to the United Nations Comtrade data compiled by Goldman Sachs, the only segment where China acquires more than 50% of its imports from the U.S. is in aircraft (63%). Moreover, the only sectors where China imports more than a third from the U.S. are seeds and agricultural products.

U.S. Companies in China Face New Challenges

The current crisis brought into public view the dangers of depending on other countries for essential products. Discontent among U.S. companies operating in China, however, had been developing for months. Several companies now indicate they are ready to reshore out of Asia. In the most recent survey by the U.S. Chamber of Commerce in China (“Chamber”), close to 9% of member companies have already started relocating out of China, and an additional 8% are thinking about doing so. In the resource and industrial (R&I) sector, a full quarter of respondents indicated they are already relocating or considering doing so – the highest proportion across industries. For some producers, remaining in China does not make commercial sense anymore. According to Lei Wang et al., for example, it is already cheaper to produce metal and oil products in the U. S. after the U.S. imposed 25% tariffs on Chinese products.

“An uncertain policy environment, rising costs [in China] and U.S. tariffs are the top three factors influencing relocation considerations,” according to AmCham China. Close to 45% of companies relocating or thinking about doing so cited an uncertain policy environment as one of the top three reasons to relocate in 2019 (up from 9% in 2018). Similarly, 40% cited rising costs, including labor costs (up from 17% in 2018), while 38% pointed to U.S. tariffs on products exported from China.

Companies that are delaying or canceling investments in China cite similar worries. About 37% of firms surveyed by the Chamber, the largest proportion since 2013, indicate they are delaying additional investments in 2020 or looking to reduce their footprint in China. This trend is even more pronounced in the R&I sector, where 43% indicate they will not invest further in the country in 2020. This group of companies also point to the tense U.S.-China bilateral relationships as the most significant barrier to investment, followed by expectations of a slowing Chinese market, rising labor costs, and uncertain local regulations.

Among the most longstanding concerns of U.S. firms in China are intellectual property (IP) protection and technological sharing. AmCham China suggests this is a lesser concern among firms than it was in past years, and that protections are improving. Close to 69% of U.S. firms surveyed indicated in 2019 that IP enforcement had improved over the past five years – with only 2% reporting that it has deteriorated. Similarly, the percentage of firms that indicated the risk of IP/data security leakage is higher in China dropped 10 percentile points year-on-year to 44% in 2019.

Despite the reported improvements, a significant portion of U.S. companies are still dissatisfied with the state of IP protection. Intellectual property and data leakages are still the second most cited barrier to increasing investment in China (38% of respondents), behind transparency and fairness of the regulatory environment. It is important to note, however, that industries differ widely about their uneasiness with IP protections. Within the technology sector, 49% of companies indicated that IP protections remain an obstacle to additional investment. R&I corporations are not far behind, with 48% reporting IP as a hurdle to investment.

Few empirical studies have examined China’s IP litigation outcomes, in part because the relevant data became available only after 2014. The longstanding notion among U.S. commentators is that the Chinese system systemically discriminates against foreign patent plaintiffs and that this phenomenon is more pronounced outside of large coastal cities. Gaétan Rassenfosse et al. supports this thesis in a paper that looks at how foreign IP litigants are treated by the China National Intellectual Property Administration (CNIPA) in the context of patent applications declared as standard essential to 3G and 4G LTE technology. Based on this subset of cases, the study finds that foreign applicants’ patents are granted between 8.8-9.3% less often than Chinese applicants’ patents and that it takes between 8.5 to 12.6 months longer for foreign applicants to obtain patents than for their Chinese counterparts. Some other scholars, however, have recently challenged the discrimination hypothesis advanced by Rassenfosse.

Regardless of their reasons for discontent, one thing is clear: U.S. firms are making less in China – a trend many industry leaders expect to continue. More than a fifth of respondents indicated that they experienced yearly revenue drops in 2019, up from only 12% in 2017. This drop was even more striking within the R&I group – in which 30% experienced sales declines, and an additional 36% remained flat. Companies in this sector were also the least optimistic about 2020, with close to 40% of firms surveyed not expecting their market to grow this year. Profitability across industries has also plunged to historic lows, with 38% of companies indicating they recorded losses or broke even.

U.S. Investment in China has Steadily Declined

Foreign direct investment (“FDI”) and bilateral trade data also support this reshoring narrative. According to research provider Rhodium Group, U.S. foreign direct investment in China rose to $14 billion in 2019, up from $13 billion in 2018. This number, however, does not tell the whole story. The uptick in investment was mostly driven by projects that had been in the works since at least 2018, including Tesla’s Gigafactory in Shanghai. In contrast, the value of newly commenced (greenfield) projects declined from $2.4 billion in 2018 to $1.4 billion in 2019, supported by an expansion of GM’s Chinese joint venture. U.S. FDI in China has been falling since approximately 2012 in many industries. For instance, between 2005 and 2011, U.S. firms channeled roughly $1.27 billion per year into machinery. In contrast, they only invested $104 million per year on average in that sector between 2018 and 2019. Likewise, investment in basic materials was $1.84 billion per year on average between 2005 and 2011, but only $321 million between 2018 and 2019.

As U.S. companies have moderated their investments in China, the U.S. has also reduced its imports form the Asian nation, partly as a response to new U.S. tariffs on Chinese goods. Imports of manufactured goods from low-cost Asian countries (“LCA”) into the U. S. dropped for the first time since 2016 in 2019– recording a decline of 7.2% to $757 billion. Last year also marks the first-time imports from LCAs fell as a percentage of domestic manufacturing output since 2011. This contraction has mainly concentrated in China, where exports to the U.S. slid 17% between 2018 and 2019 to $90 billion. This trend has continued into the first few months of 2020. Imports of goods from China fell 29% year-on-year in the first quarter of this year, according to the BEA. Imports of consumer goods from that country shrank by close to 30%, while those of vehicles and automotive components, industrial supplies, and other capital goods diminished between 20% and 30%. This decline has been partially offset by a $31 billion expansion in imports from other LCAs. In particular, 46% of this amount was absorbed by Vietnam, which is also a popular choice for Chinese businesses looking to cut costs. After this shift, China accounted for 56% of U.S. manufacturing imports from LCA’s, down from 67% in 2013.