The COVID-19 pandemic has been particularly hard on small businesses, which are estimated to employ nearly half of all American workers. A recent Federal Reserve Bank study noted that the pandemic caused an additional 200,000 businesses to close their doors last year, with small businesses comprising the bulk of the difference.

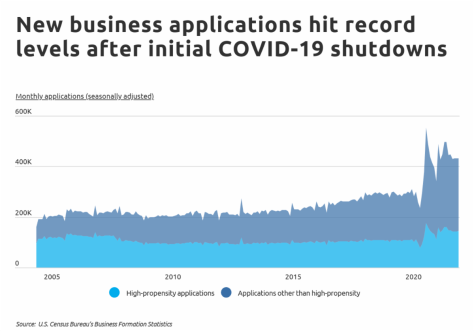

However, it hasn’t been all bad news for the nation’s small businesses. A real-time survey of business applications conducted by the U.S. Census Bureau offers encouraging results: the increase in business shutdowns combined with changes in consumer preferences created gaps for new entrants to fill, resulting in a strong resurgence of new businesses. Between 2019 and 2020, there was a nearly 25% increase in new business applications, and that increase has held relatively steady through 2021. About one-third of current applications are considered “high-propensity applications,” or those with a high likelihood of turning into a business with payroll.

At the industry level, the increase in new business applications is being led by the retail trade sector of the economy. When comparing the number of applications from 2019 to 2020, retail trade applications increased by 59%, followed by the transportation sector which increased nearly 35%. Further, the largest percentage increases in applications were more likely to occur in those sectors already generating the highest number of applications overall. Together, this indicates the start of a robust trend for total small business creation in the economy.

While total business applications grew markedly since the beginning of the pandemic, the strongest increases appeared in the Southeast. Mississippi, Georgia and Louisiana lead the nation with application increases of over 55%. Yet, not all states fared well, as Alaska and North Dakota each saw small, single-digit percentage decreases over the same time period. At the metro level, those reporting the largest increases in new business applications are also found in the Southeast, with a handful of locations in Texas and the Midwest also ranking highly.

The data used in this analysis is from the U.S. Census Bureau. To determine the locations with the largest increase in new business applications since COVID-19, researchers at Self Financial calculated the percentage change in new business applications from 2019 to 2020. In the event of a tie, the location with the higher total change in business applications from 2019 to 2020 was ranked higher.

Here are the large U.S. metropolitan areas with the largest increase in new business applications since the start of the pandemic.

| Metro | Rank | Percentage change in business applications (2019-2020) | Total change in business applications (2019-2020) | Total business applications in 2020 | Total business applications in 2019 |

|---|---|---|---|---|---|

| Memphis, TN-MS-AR | 1 | +77.7% | +11,554 | 26,431 | 14,877 |

| Atlanta-Sandy Springs-Alpharetta, GA | 2 | +56.8% | +73,365 | 202,603 | 129,238 |

| New Orleans-Metairie, LA | 3 | +55.6% | +10,659 | 29,830 | 19,171 |

| Cleveland-Elyria, OH | 4 | +54.5% | +11,302 | 32,045 | 20,743 |

| Chicago-Naperville-Elgin, IL-IN-WI | 5 | +49.7% | +51,394 | 154,758 | 103,364 |

| Detroit-Warren-Dearborn, MI | 6 | +48.9% | +26,947 | 82,098 | 55,151 |

| Milwaukee-Waukesha, WI | 7 | +37.6% | +5,773 | 21,127 | 15,354 |

| Houston-The Woodlands-Sugar Land, TX | 8 | +37.4% | +32,185 | 118,183 | 85,998 |

| Charlotte-Concord-Gastonia, NC-SC | 9 | +35.3% | +11,879 | 45,487 | 33,608 |

| Birmingham-Hoover, AL | 10 | +35.3% | +4,070 | 15,593 | 11,523 |

| Virginia Beach-Norfolk-Newport News, VA-NC | 11 | +35.0% | +6,683 | 25,783 | 19,100 |

| Philadelphia-Camden- |

12 | +33.4% | +25,103 | 100,265 | 75,162 |

| Riverside-San Bernardino-Ontario, CA | 13 | +32.2% | +10,944 | 44,887 | 33,943 |

| Fresno, CA | 14 | +32.1% | +1,782 | 7,332 | 5,550 |

| Jacksonville, FL | 15 | +31.8% | +7,537 | 31,202 | 23,665 |

| United States | – | +24.2% | +848,210 | 4,356,870 | 3,508,660 |

For more information, a detailed methodology, and complete results, you can find the original report on Self Financial’s website: https://www.self.inc/blog/us-